When it comes to forex trading, it’s all about…. Currency Pairs.

When it comes to forex trading, it’s all about…. Currency Pairs.

In Online Forex Trading you do not buy euros or US Dollars, like when you wanna travel abroad.

Forex is about trading currency pairs. This means that a trader buys a position, in EUR/USD.

A Long Position is when you expect the euro to increase over the USD.

A Short Position on the other hand is when you expect EUR to decrease over USD.

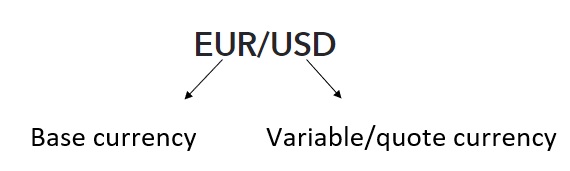

In EUR/USD Currency Pair, the euro is called the base currency, while the USD is the quote currency.

In Online Forex Brokers we meet many currency pairs divided by categories.

Major Currency Pairs

Major Currency Pairs are considered the pairs that contain US Dollar. USD can be a Quote Currency or a Base Currency.

Major Currency Pairs are suitable for short terms strategies, such as scalping, intraday trading, day trading, trading the news, etc because of their huge liquidity.

3 Most Known Currency Pairs are:

-

EUR/USD

Almost 1 out of 4 trades daily is made on EUR/USD Currency Pair. EUR/USD is the pair that “connects” the two bigger economies on the planet. The US Economy and the Eurozone. EUR/USD can be found in almost all forex brokers worldwide, and its live price graph is provided by Plus500. EUR/USD is the pair with the higher liquidity in the market, which generally means tighter spreads.

-

USD/JPY (the “gopher”)

In position number 2, we find the USD/JPY (US Dollar / Japanese Yen) which has the nickname “the gopher”. USD/JPY is representing 13,2% of the daily forex trading volume. USD/JPY is famous among Asian Traders because they like trading a “familiar” currency, the Japanese Yen. It is also a trading pair with high liquidity, which is good news for traders.

-

GBP/USD (the “cable”)

In position number 3, we find the GBP/USD (US Dollar / Japanese Yen) which has the nickname “the cable”. In this pair, we find the UK Pound Sterling as base Currency and the US Dollar as Quote Currency. GBP/USD represents 10% of the daily forex trading volume.

GBP/USD is a famous trading pair for UK-based Traders because they have a special “relation” with the Sterling Pound. It also connects two of the most important economical centers, London and New York.

In the following table, you can some more Major Currency Pairs

| Abbreviation | Currencies | NickName | Symbol |

| EUR/USD | euro/US Dollar | – | €/$ |

| USD/JPY | US Dollar / Japanese Yen | “the gopher” | $/¥ |

| GBP/USD | Pound Sterling/USA | “the cable” | £/$ |

| AUD/USD | Australian Dollar/US Dollar | “Aussie dollar” | €/$ |

| USD/CAD | US Dollar/Canadian Dollar | “dollar loonie” | €/$ |

| NZD/USD | New Zealand Dollar/US Dollar | “kiwi dollar” | €/$ |

| USD/CHF | US Dollar/Swiss Franc | “dollar swissy” | €/$ |

| USD/TRY | US Dollar/Turkish Lira | – | $/₺ |

Minor Currency Pairs

Minor Currency Pairs are Pairs that do not contain

Exotic Currency Pairs

Currency pairs with lower liquidity and higher spreads, because of low trading demand!

Such exotic currency

Leverage Restrictions in EU (ESMA)

ESMA (European Securities and Markets Authorities) on 27th of March 2021 has set some restrictions regarding CFD Trading and Binary Options.

These Restrictions apply to retail investors.

If you want more information about ESMA Restrictions and how they apply to EU Traders, read our guide: EU Forex Brokers.

Instrument |

Max Leverage |

| Major Currency Pairs (EUR/USD etc) | 30:1 |

| Non-Major Currency Pairs | 20:1 |

| Gold and major equity indices | 20:1 |

| Commodities other than Gold | 10:1 |

| For individual equities | 5:1 |

| Cryptocurrencies | 2:1 |