In the table below you can see the LIVE US Dollar Index (USDX) exchange rate today and the historical price chart as offered by Plus500.com.

In the table below you can see the LIVE US Dollar Index (USDX) exchange rate today and the historical price chart as offered by Plus500.com.

The price bellow is not a market price, it is a CFD price offered by Plus500.com (which is close to the market actual price).

If you want to take advantage from the price fluctuations of US Dollar Index (USDX) you can start trading in Plus500.

U.S. Dollar Index Plus500

U.S. Dollar Index FAQ

U.S dollar Index is a measurement of the value of the U.S dollar (USD).

It has been established in 1973 valued 100. If USDX is more than 100, this means that USD is strenther than 1973.

Nowedays, USDX is valued below 100, which means that USD is weaker than 1973.

Since the national currency’s value is the mirror of the economy, it no doubt means that us economy is weaker than 1973 in a worldwide level.

US Dollar Index is associated with a basket of currencies (six currencies) used in foreign exchange market which is called the US trade partner’s currencies basket.

The U.S Dollar Index rises its value when the USD rises its value compared to the other basket currencies.

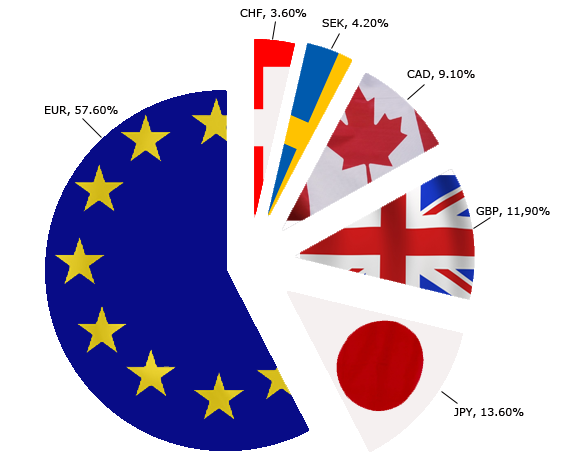

In the table below you can see the weight of every different currency used to calculate the US Dollar Index:

| Euro(EUR) | 57.6% weight |

| Japanese yen (JPY) | 13.6% weight |

| Pound sterling (GBP) | 11.9% weight |

| Canadian dollar (CAD) | 9.1% weight |

| Swedish Krona (SEK) | 4.2% weight |

| Swiss franc (CHF) | 3.6% weight |

These currencies include 24 countries. The number of countries is higher than the number of currencies, because of euro. 19 countries in Europe use the Euro currency forming an Economic Union, the Eurozone.

Eurozone, as a total, is the second most important economy in the world (after USA) containing very competitive ecomomies like France, Germany, Italy, Spain, Holland, Belgium etc.

Japan, United Kindom, Canada, Sweden and Switzerland are using the other currencies of the basket.

U.S Dollar Index (USDX) is a reliable index for measuring the USD strength, mostly because we compare the USD to the other most important economies of the world (Excluding China).

These 24 countries are a small percent of the total world, however the impact they have in world’s economy makes many currencies’ exchange rate to follow the movement of the US Dollar Index.

Due to the size of Eurozone, the Euro comes first in the weight rank. It makes a big part of US dollar index, more than half.

The second one is Japanese yen . The reason behind this is that Japanese economy comes after Euro in weight rank. These two make a huge weight while the other four making less than 30 percent of the US dollar index.

- Pound sterling makes 11.9 % of the weight.

- Canadian Dollar makes 9.1%.

- Swedish Krona makes 4.2%.

- Swiss Franc makes a very less and comes at the end which is 3.6%.

There is a quite tricky question.

As euro makes the highest geometric weight average, so, if euro’s exchange rate decreases, what will happen to the US dollar index?

So if there is any fall in euro, it will affect the US dollar index negatively. This is called the Anti-Euro index.

If you like to trade USD currency pairs like the EUR/USD, GBP/USD, USD/JPY then US Dollar Index may be your next trading asset.

US Dollar Index Trading Facts

- US Dollar Index can be used as an indicator of EUR/USD price movement.

- US Dollar Index can be used as an indicator for gold, oil and US Treasury bonds prices.

- If a currency pair has the american dollar as base currency (for example USD/CAD) then both USDX’s and the currency pair’s price will move the same direction

- If a currency pair doesn’t have the US Dollar as base currency (for example EUR/USD) then prices will move the opposite.

Trading U.S. Dollar Index in Plus500

Plus500 Trusted Review

- A popular CFD Broker in Europe, UK and Australia

- 2100+ popular CFD instruments

- Mobile, web or tablet trading

- Paypal Deposits & Withdrawls

- State of the Art Reliable Company

USD Dollar Index is a famous CFD instrument in Plus500.

Trade US Dollar Index CFD in Plus500, or try another among 2100+ trading instruments!

Open a demo account fast in a highly recommended CFD Trading Broker regulated by CySec. (license number 250/14).